The Long Straddle

A long straddle is a simple yet sophisticated options position that involves buying both at the money call and put, where the strike price of both options is close to the current stock price, with the same expiration date, usually going past the earnings date.

The theory behind the long straddle is that the buyer of the position expects a high degree of volatility after the company releases earnings, but they are unsure in which direction the price will change.

The long straddle provides positive exposure to a significant price move in either direction, with a chance to profit as long as the price change is large enough to cover the premiums regardless of the direction of the change.

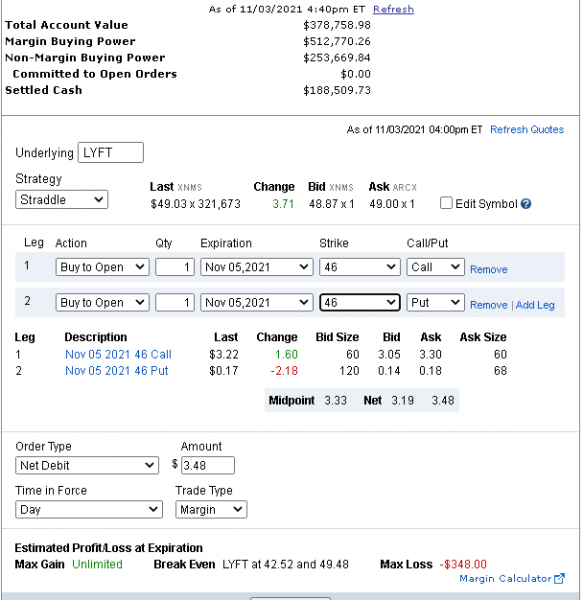

With this strategy you have two break even spots with the first one being the strike price plus the net debit paid and the other being the strike price minus the net debit paid.

So for example, if you bought a long straddle on Netflix with a strike price of $195 for a net debit of $17.45 ($1,745 total cost) then your breakeven points would be $212.45 and $177.55. You would need the stock to move above or below those prices in order to be profitable but keep in mind that theta (time decay) and implied volatility will affect prices before earnings are announced.

- Buy earlier – 2 -3 weeks prior to earning announcement – it is far more reliable to buy two to three weeks before earnings and let implied volatility juice up the premiums.

- Get out earlier – you could collect profits before earnings and not risk getting burned because even if the stock makes a big move, if it isn’t enough the premium in the options will be sucked out as implied volatility plummets.

- Stocks With High Volatility On Earnings Reports – Think of companies such as Amazon, Apple and Netflix. These companies all have volatile earnings with price movements regularly reaching more than 5% up/down post earnings. These volatile names usually build up anticipation and with that comes high implied volatility. Implied volatility is a key metric in pricing options so when that spikes up like it typically does before earnings we can also see a hefty rise in option premiums even if the stock doesn’t move much!

- Bolinger Bands are getting narrower and about to expand